Key events

Introduction: China’s trade surplus hits $1tn

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

China’s annual trade surplus has exceeded $1trn for the first time, as the manufacturing powerhouse shrugged off the impact of Donald Trump’s trade war.

New trade data today shows that Chinese factories swelled their sales to non-US markets this year, making up from a sharp drop in shipments to the US.

In November, China’s exports grew 5.9% year-on-year, customs data shows. That reverses a 1.1% contraction in October, and beats analyst forecasts.

And for the first 11 months of the year, China’s annual trade surplus (the difference between what it exported and imported), rose above the $1trn mark for the time (by my maths it was over $1.070tn).

While exports to the US have slowed this year, due to the trade tensions between Washington and Beijing, China has turned to other market – such as Europe.

Lynn Song, ING’s chief economist for Greater China, explains:

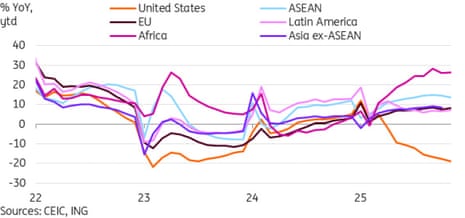

November exports to the US were down -28.6% YoY, a three-month low, bringing the year-to-date growth to -18.9% YoY. It’s likely that November exports have yet to fully reflect the tariff cut, which should feed through in the coming months.

Also, the frontloading effect as US importers ramped up purchases ahead of tariffs will act as a headwind on trade in the coming months. Instead of the US, the beat in November’s data came from an acceleration of exports to the EU

By product, Song adds, familiar categories continued to see the strongest growth; Ships (26.8%), semiconductors (24.7%), and autos (16.7%).

China’s rare earth exports jumped 26.5% month-on-month in November, Reuters reports – that’s the first full month after Xi and Trump agreed to speed up shipment of the critical minerals from the world’s largest refiner.

Soybean imports are also poised for their best-ever year, as Chinese buyers, who had shunned US purchases for the majority of this year, stepped up purchases from American growers in addition to large purchases from Latin America.